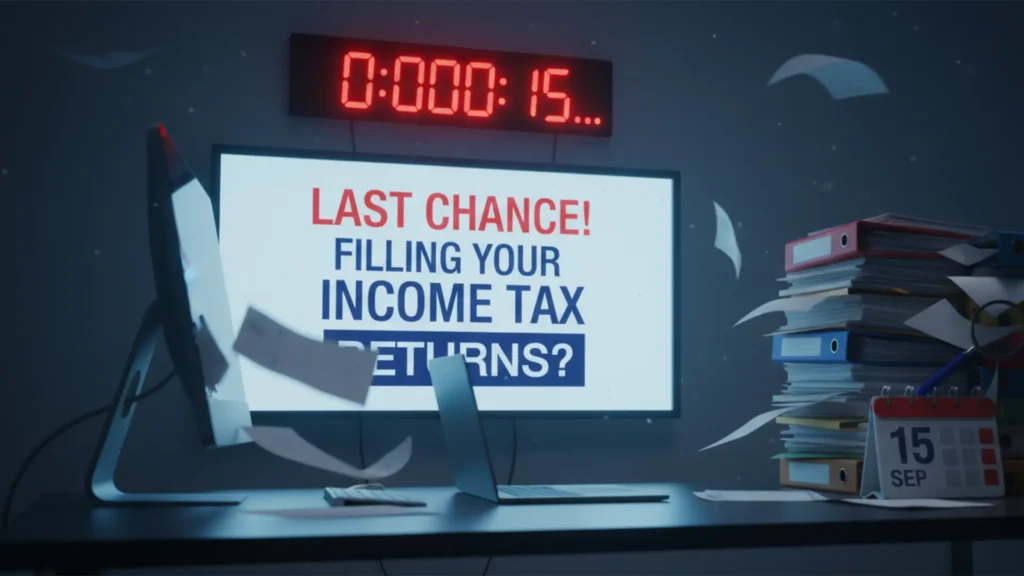

The final countdown has begun. The extended deadline for filing your Income Tax Return (ITR) for the 2024-25 financial year is September 15, 2025, and it is looming large. After this date, the window for filing without a penalty slams shut.

If you are one of the millions of Indians who haven’t filed yet, the last-minute pressure can be stressful. But don’t worry. This is not just another news report; this is your ultimate, simple, step-by-step guide to getting your ITR filing done correctly and without stress.

The deadline was extended from July 31st due to genuine hardships, including severe flooding in states like Uttarakhand and technical issues on the portal. Now, with this final opportunity, let’s get it done.

Also Read: ITR Filing Deadline Missed? You Still Have One Last Chance, But With a Penalty!

Step 1: Get Your Documents Ready (The 5-Minute Checklist)

Before you even log in, take five minutes to gather these essential documents. Having them ready will make the process ten times faster.

✅ PAN Card: Your primary identification.

✅ Aadhaar Card: Make sure it is linked with your PAN.

✅ Form 16: If you are a salaried employee, this is your most important document. Your employer provides it, and it has all the details of your salary and the tax deducted (TDS).

✅ Bank Statements: You’ll need the summary of interest earned on your savings accounts for the last financial year (April 1, 2024 – March 31, 2025).

✅ Proof of Investments (if any): If you want to claim deductions, have the details of your investments ready (e.g., LIC, PPF, mutual funds (ELSS), home loan interest, medical insurance premium receipts).

Step 2: Filing Your ITR Online (A Simple Walkthrough)

The online process is now easier than ever. Just follow these steps carefully.

Go to the Official Portal: Open your browser and go to the only official Income Tax website:

incometax.gov.in. Beware of fake websites.Login and Start: Log in with your PAN (which is your User ID) and password. Click on the “File Now” button for the current Assessment Year (AY 2025-26).

Verify Pre-filled Data: The best part about the new portal is that it automatically fetches a lot of your data from your employer and bank. It will show you your pre-filled salary, interest income, and TDS details. Your job is to carefully check if this information is correct.

Add Missing Income: The portal might miss some things. Be honest and add any other income you have, like interest from savings accounts or fixed deposits.

Claim Your Deductions: This is how you save tax. In the “Deductions” section, fill in the amounts you invested in schemes under Section 80C, 80D (health insurance), etc.

Check Your Final Tax Calculation: The portal will show you a summary of your total income, total deductions, and your final tax liability. It will tell you if you owe any tax or if you are due a tax refund.

Step 3: Pay Your Tax and E-Verify (The Most Important Step)

You’re almost done! This final step is crucial.

If Tax is Due: If the portal shows you have tax to pay, pay it immediately using the “Pay Now” option. You can use UPI, net banking, or your debit card.

E-VERIFY YOUR RETURN: This is the most critical step. If you do not verify your ITR, it will be considered as not filed. The easiest and fastest way to do this is by selecting the “Aadhaar OTP” option. An OTP will be sent to the mobile number linked with your Aadhaar, and your return will be verified instantly.

The Cost of Inaction: What Happens After Sept 15?

If you still miss this final deadline, the consequences are automatic and unavoidable.

Late Fee: You will have to pay a penalty of ₹5,000 (or ₹1,000 if your income is below ₹5 lakh).

Interest: You will be charged interest of 1% per month on any tax you owe.

No Carry Forward of Losses: You will lose the ability to carry forward stock market or business losses.

Pro-Tips for Last-Minute Filers

Don’t Wait for September 15th: The portal will be extremely slow on the last day. Plan to file your return between now and September 13th to avoid the traffic.

Pre-Validate Your Bank Account: Make sure the bank account where you want to receive your refund is pre-validated on the portal.

Save Everything: After you finish, download the ITR-V (acknowledgment) and the complete ITR form PDF. Keep them safe.

Also Read: Maruti Suzuki Victoris Launching Oct 2025: Price, Features, 5-Star Safety

Conclusion: Your Weekend Mission

You have this final week. The process of income tax filing is no longer as complicated as it once was. Set aside one hour, follow this simple guide, and complete your legal and moral duty. You will not only avoid penalties but will also enjoy the peace of mind that comes with being a responsible citizen and always update with zigFeed.